Running a Banking Website on Azure: Part 2 - Business Logic, Data Management & Integration

In Part 1, we established the security foundations and edge architecture that protect financial workloads on Azure - covering secure ingress, layered WAF enforcement, and private network boundaries.

In Part 2, we move deeper into the platform - into the systems that process transactions, manage financial data, and integrate with legacy core platforms. This is where architectural decisions have the greatest impact on reliability, performance, and data integrity.

This installment explores how containerized microservices implement business logic, how different data stores serve distinct roles, and how modern cloud platforms integrate with decades-old on-premises and mainframe-based systems. We'll examine the critical distinction between authoritative and non-authoritative data, explore messaging patterns that ensure reliability, and understand how to connect cloud systems with mainframe-based core banking platforms.

Business Logic: Containers and Microservices

The core business logic - the code that processes transactions, calculates interest, and handles transfers - runs on Azure Kubernetes Service (AKS).

Kubernetes orchestrates containers. Instead of deploying applications directly onto virtual machines, code is packaged into containers - self-contained units that include the application, runtime, libraries, and dependencies. Kubernetes then manages how these containers are deployed, scaled, healed, and upgraded across the platform.

For financial workloads, this model is not about trend-following - it directly addresses long-standing operational and reliability challenges.

Why This Matters for Financial Platforms

Consistency across environments

A container that runs on a developer’s laptop runs the same way in test and production. This eliminates environment-specific surprises and the classic “it works on my machine” problem - an important control in regulated change management.

Efficient resource utilization

Containers are lightweight compared to full virtual machines. Multiple services can run securely on the same node, improving infrastructure utilization while maintaining isolation between workloads.

Built-in resilience

Kubernetes continuously monitors container health. If a container crashes, it is restarted automatically. If a node fails, workloads are rescheduled onto healthy nodes. From the application’s perspective, availability is maintained without manual intervention.

Fine-grained, service-level scaling

Not all banking functions scale the same way. Payment processing may spike at month-end, while account lookups remain steady. Kubernetes allows individual services to scale independently, ensuring capacity is added only where it’s needed.

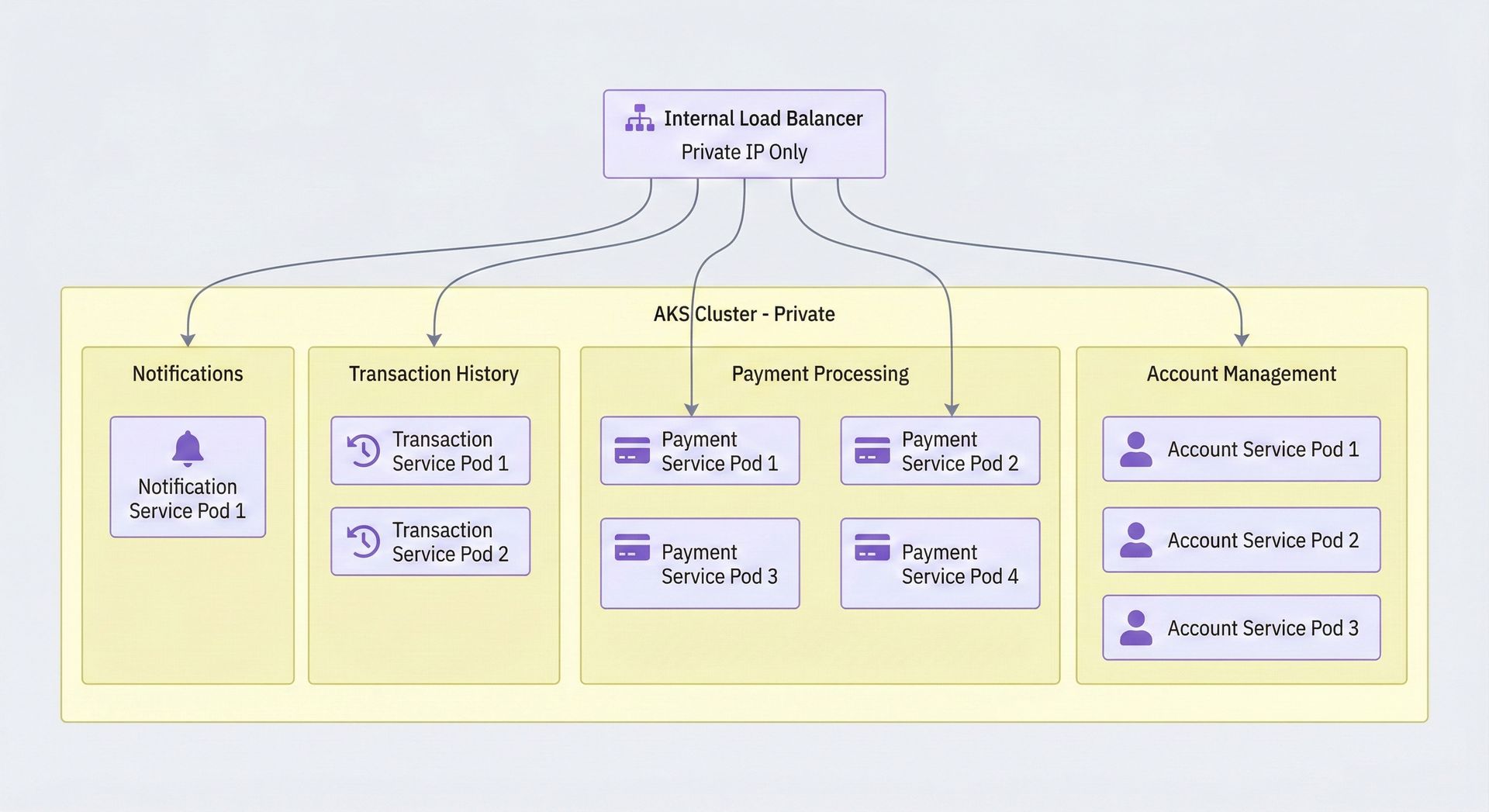

A typical banking deployment on AKS might look like this:

Each service runs multiple instances, known as pods. When demand increases - for example, during peak payment periods - only the payment processing pods scale out. Account management and transaction history services remain unaffected, ensuring capacity is added precisely where it’s needed.

Importantly, the load balancer is internal-only. It has no public IP address and is reachable exclusively from within the Virtual Network, ensuring that backend services remain completely isolated from direct internet access.

Messaging: Keeping Everything in Sync

In financial systems, reliability is paramount. When a customer transfers $10,000, that transaction must complete atomically and durably according to ACID principles (Atomicity, Consistency, Isolation, Durability). Crucially, this happens inside the database, not through a messaging system.

Messaging plays a different role.

Azure Service Bus provides the backbone for asynchronous communication between services - work that must happen after a transaction completes, but does not need to be part of the transaction itself.

A Practical Example

Consider a customer initiating a money transfer:

The payment processing service executes the transfer as a single ACID transaction in the database

Account A is debited and Account B is credited atomically - either both succeed or neither does

Once the transaction commits successfully, an event is published to Service Bus:

“Transfer of $500 completed from Account A to Account B”The notification service consumes the message and sends a confirmation email

The fraud detection service consumes the same message to analyze transaction patterns

The reporting service consumes it to update dashboards and daily statistics

The key point: the financial transaction is already complete and safe before any message is published.

This is why customers may receive confirmation emails a few seconds - or even minutes - after completing a transfer. The money movement happened instantly and atomically in the database; the follow-up actions are handled asynchronously.

Resilience Through Decoupling

If a downstream service fails - for example, if the notification service crashes or becomes overloaded - Service Bus retains the message. When the service recovers, it processes the backlog.

The customer’s money is never at risk. At worst, a confirmation email is delayed.

This decoupling is essential in banking systems. It prevents non-critical failures from impacting core transaction processing.

Messaging Patterns Used in Banking

Service Bus supports several patterns commonly used in financial platforms:

Queues

First-in, first-out delivery. Ideal for ordered processing, such as settlement workflows or batch tasks.Topics and subscriptions

One message fan-outs to multiple subscribers. A single “payment completed” event can be consumed independently by notifications, fraud detection, reconciliation, and reporting services.Dead-letter queues

Messages that cannot be processed after multiple retries are moved aside for investigation, preventing malformed or problematic messages from blocking the system.Scheduled delivery

Messages can be scheduled for future processing, enabling use cases like scheduled payments, reminders, or delayed reconciliations.

Data Storage: Where the Money Actually Lives

Everything discussed so far - security, networking, and compute - means nothing if the data layer fails. This is where customer balances, transaction records, and account details live, and where correctness, durability, and auditability matter more than anything else.

Azure SQL Database: Relational Data and the Source of Truth

Azure SQL Database (or any other RDBMS) handles structured, relational data - accounts, customers, ledgers, and transactions. More importantly, it serves as the authoritative source of truth for all financial data.

In financial architectures, this distinction is fundamental:

Authoritative data

The single, definitive record that is legally and financially binding (account balances, ledger entries, transaction records)Non-authoritative data

Derived views, cached representations, or read-optimized copies used for performance and user experience

Azure SQL Database is where authoritative data lives. Every dollar amount, every balance, every transaction - if it matters legally and financially, it exists in SQL Database first. Other data stores may reflect this information, but they never replace it.

Why Azure SQL Database Fits Financial Workloads

For banking and regulated financial systems, Azure SQL Database provides capabilities that are essential rather than optional:

Point-in-time restore

Databases can be restored to any point within the retention window (up to 35 days), enabling recovery from accidental deletes or application errors.Geo-replication

Authoritative data can be replicated to secondary regions. If the primary region fails, a secondary can take over with minimal downtime and data loss.Transparent Data Encryption (TDE)

All data is encrypted at rest by default, protecting customer information even in the event of physical media compromise.Advanced threat protection

The platform continuously monitors for anomalous behavior such as unusual query patterns, SQL injection attempts, or access from unexpected locations.Automatic tuning

Query performance is analyzed continuously, with indexes and optimizations applied automatically to maintain consistent performance.Zone redundancy

In production deployments, SQL Database can synchronously replicate data across availability zones, protecting against data-center-level failures.

Azure SQL Database delivers the consistency, durability, and auditability required for systems that manage money - making it the natural home for the most critical financial data in the platform.

Azure Cosmos DB: Global Distribution for Non-Authoritative Data

While Azure SQL Database is the system of record for authoritative data such as balances and ledgers, Azure Cosmos DB addresses a different requirement: fast, globally distributed access to read-optimized, non-authoritative data.

Cosmos DB is designed for scenarios where low latency, flexible schemas, and global reach matter more than strict, cross-region transactional consistency.

Common Financial Use Cases

In banking and financial platforms, Cosmos DB is typically used for:

Transaction history views

Read-only projections of transaction data that can tolerate brief delaysPersonalization data

User preferences, UI configuration, recently viewed accountsSession-related state

In-progress applications, saved drafts, or temporary user contextAnalytics and reporting views

Aggregated, non-authoritative datasets used for dashboards and insights

The Core Architectural Rule

Authoritative balances and ledger entries remain in strongly consistent relational systems.

Cosmos DB complements these systems by providing fast, globally distributed access to supporting data. Any data stored in Cosmos DB must be rebuildable from the authoritative source in Azure SQL Database if required.

A Practical Example

Consider a bank operating across multiple continents:

A customer’s authoritative balance is stored in Azure SQL Database in their home region.

Their transaction history view - a read-only projection - is replicated globally using Cosmos DB.

When the customer travels and accesses their account from Europe, transaction history loads with low latency from a nearby Cosmos DB replica.

Balance checks and money movement still route to the authoritative SQL Database.

This pattern delivers global performance without compromising financial correctness.

Azure Cosmos DB supports multiple consistency models, allowing architects to balance correctness, latency, and global scale:

Strong consistency

Every read reflects the most recent write. This behaves like a traditional strongly consistent database but incurs higher latency at global scale due to cross-region coordination.Eventual consistency

Reads may return slightly stale data, but replicas converge over time. This provides much higher throughput and lower latency, making it suitable for scenarios such as transaction history views where minor delays do not impact operations.Session consistency

Within a single user session, reads follow writes. A customer who has just completed a transfer will immediately see it reflected in their own transaction list, even if other users see it a few seconds later.

In practice, most financial platforms use session consistency for non-authoritative data. It offers an effective balance between user experience and performance, while preserving the integrity of authoritative financial records maintained elsewhere.

Redis Cache: The Speed Layer

Azure Cache for Redis sits in front of primary databases, storing frequently accessed data in memory. Memory access is orders of magnitude faster than disk-based storage, making Redis ideal for accelerating read-heavy workloads.

In financial platforms, Redis is used to improve responsiveness, not to replace authoritative data stores.

A Typical Balance Read Flow

When a customer checks their account balance:

The application first queries Redis

If a recent value exists, it is returned immediately (≈1 millisecond)

If the value is missing or stale, the application queries Azure SQL Database for the authoritative balance (≈50 milliseconds)

The result is cached in Redis with a short time-to-live (for example, 30 seconds) for subsequent requests

This approach dramatically reduces database load while keeping customer-facing responses fast.

A Critical Distinction

Cached balances are used only for read-only display and are refreshed aggressively using short time-to-live (TTL) values. Authoritative balances are always validated against the primary database for any transactional operation - transfers, withdrawals, or any action that modifies account state.

The cache exists to accelerate reads, never to participate in financial transactions.

For read-heavy scenarios such as balance checks and transaction history views, caching delivers significant performance improvements while reducing load on the primary database - without compromising data integrity.

Session Management with Redis

Redis is also commonly used for session storage. When a customer logs in, session state is stored in Redis rather than on individual application instances. Because this state is in-memory and centrally accessible, customers remain logged in even when subsequent requests are served by different application servers.

This pattern improves scalability and resilience while maintaining a consistent user experience.

Connecting to Core Banking Systems

Here’s the reality: most banks do not run their core banking systems in the cloud. Account ledgers, loan processing engines, and settlement systems often live on mainframes or on-premises platforms that have evolved over decades. These systems are stable, heavily tested, and deeply embedded in regulatory and operational processes. Replacing them outright introduces unacceptable risk.

As a result, cloud-based banking platforms must integrate with these on-premises core systems - securely, reliably, and predictably.

Azure provides two primary connectivity options for this integration:

Azure ExpressRoute

Azure ExpressRoute provides a dedicated, private connection between Azure and the bank’s on-premises network that does not traverse the public internet.

Higher bandwidth and lower latency

Predictable, consistent performance

Private connectivity aligned with regulatory expectations

For production financial workloads, ExpressRoute is strongly recommended. When processing payments, updating ledgers, or querying core systems, reliability and determinism matter far more than setup speed or initial cost.

Azure VPN Gateway

Azure VPN Gateway establishes an encrypted tunnel over the public internet between Azure and the bank’s data center.

Cost-effective and relatively quick to deploy

Suitable for development, testing, or low-throughput workloads

Performance depends on internet conditions and is less predictable

VPN Gateway is often used as an initial connectivity option or as a backup path - but rarely as the primary connection for core banking traffic.

Enterprise Foundation: Azure Landing Zones

Before deploying any of the services described so far, production financial platforms establish a proper enterprise foundation using Azure Landing Zones (ALZ). This is not merely best practice - it is the architectural baseline that Microsoft, auditors, and financial regulators expect for regulated workloads.

Azure Landing Zones provide a structured, scalable subscription model with built-in governance, security, and compliance controls. Banks and regulated institutions rarely deploy workloads into a single, flat subscription. Instead, they adopt a multi-subscription architecture with clear separation of responsibilities and blast-radius control.

The Typical Financial Landing Zone Structure

A production financial deployment typically uses the following subscription layout.

Platform Subscriptions (Central IT Ownership)

These subscriptions provide shared, organization-wide services:

Connectivity Subscription

Hosts ExpressRoute and VPN gateways, Azure Firewall, and core networking components. This subscription owns the hub in a hub-and-spoke network topology.Management Subscription

Contains centralized operational and security services such as Microsoft Sentinel (SIEM), Log Analytics workspaces, Azure Monitor, and centralized backup. All security telemetry and operational logs flow through this subscription.Identity Subscription

Dedicated to identity infrastructure, directory services, and related controls that underpin authentication and authorization across the platform.

Application Subscriptions (Application Team Ownership)

Each workload is deployed into isolated subscriptions:

Production Financial Workloads Subscription

Hosts customer-facing and backend services such as App Service, API Management, AKS, and databases.UAT / Staging Subscription

Pre-production environment for validation and controlled testing.Development Subscription

Isolated environment for development and experimentation, with no access to production data.

Why This Structure Matters

This separation delivers several critical benefits for regulated environments:

Blast radius containment

Misconfigurations or failures in development or testing environments do not impact production workloads.Clear cost and ownership boundaries

Each subscription has independent billing, making it easy to attribute costs to applications, environments, and teams.Separation of duties

Network teams manage connectivity, security teams manage monitoring and policy, and application teams manage their workloads - without excessive cross-access.Audit clarity

Auditors can clearly identify which subscriptions process customer data and which do not, simplifying compliance reviews.

Hub-and-Spoke Network Topology

The Connectivity subscription establishes a hub virtual network that centralizes shared infrastructure:

ExpressRoute gateway for on-premises connectivity

Azure Firewall for centralized ingress and egress control

Network security and monitoring components

Each application subscription deploys a spoke virtual network that peers with the hub. The banking or financial application - App Service, API Management, AKS - runs entirely within the spoke.

Traffic to on-premises core systems flows through the hub’s ExpressRoute gateway

Internet-bound traffic is routed through Azure Firewall for inspection and logging

This model allows application teams to focus on building services, while networking and security controls are enforced centrally and consistently.

Why Regulators Care

Regulators and auditors expect this level of organizational and architectural maturity. A well-implemented Azure Landing Zone demonstrates that the organization understands enterprise cloud governance, not just cloud deployment.

It marks the difference between “we are experimenting with the cloud” and “we are operating regulated financial workloads at scale.”

Landing Zones also make growth predictable. Launching a new digital service does not require redesigning networking or security - teams simply deploy a new spoke subscription that inherits established controls.

Closing Thoughts

In this second part, we explored the internal mechanics of a production-grade financial system on Azure - from containerized microservices executing business logic to the deliberate separation of data responsibilities across multiple storage platforms.

We examined the critical distinction between authoritative financial data stored in Azure SQL Database and non-authoritative, supporting data served from systems such as Cosmos DB and Redis. We saw how Azure Service Bus enables reliable, asynchronous communication between services without compromising the atomicity and integrity of financial transactions.

We also looked beyond application code to the enterprise foundations that make these systems operable at scale. Azure Landing Zones establish the governance, security, and operational boundaries that regulators expect, while Azure ExpressRoute bridges modern cloud platforms with long-standing core banking systems. Together, these patterns allow banks to modernize customer-facing capabilities without taking on the risk of wholesale replacement of proven backend systems.

At this point, the functional architecture is complete - but a production banking system is not finished when it works. It is finished when it can withstand failure, be observed in real time, pass audits, and operate sustainably over time.

In Part 3, we complete the picture by focusing on:

High availability and disaster recovery

Monitoring, alerting, and operational excellence

Compliance, auditing, and regulatory readiness

Cost management and financial governance

Next: Part 3 - Operations, Compliance & Resilience

If you found this useful, tap Subscribe at the bottom of the page to get future updates straight to your inbox.